- That's so Meta

- Posts

- Latest Meta Jobs + Analyst Chatter

Latest Meta Jobs + Analyst Chatter

Ahoy Metamates! 🚢 🏴☠️

This months second issue is a bit late on account of - I temporarily lost my vision (long story), but we’re back and running all cylinders now. I’m working on our September deep-dive issue now and I’m excited to send it out next week!

🆕 The TLDR This Week:

The Latest on Jobs

…. aaaaaaand we’re back! Meta is hiring on all cylinders again and telling analysts openly that talent costs are going up. Which begs the question how much of layoffs were cost saving vs strategy shift.

Open roles as of today:

~300 PM roles ( 230 in MPK). The ones I found most juicy are:

Some interesting Ops roles

Notable New Hires

One of the most storied eng leaders of Google, Bhavesh Mehta, left recently to join Meta. Over his 18 year Google career he’s led eng for Maps, Shopping, Adsense, Display Ads and Robotics.

Aaron Anderson left Paypal, where he was Treasurer, to join Meta as CAO. This is part of a huge push for Meta to bring down costs on accounting and finance, which have skyrocketed. Expect to see a ton of hires in tax, corp finance and treasury.

Morgan Stanley’s Opinion on AI @ META

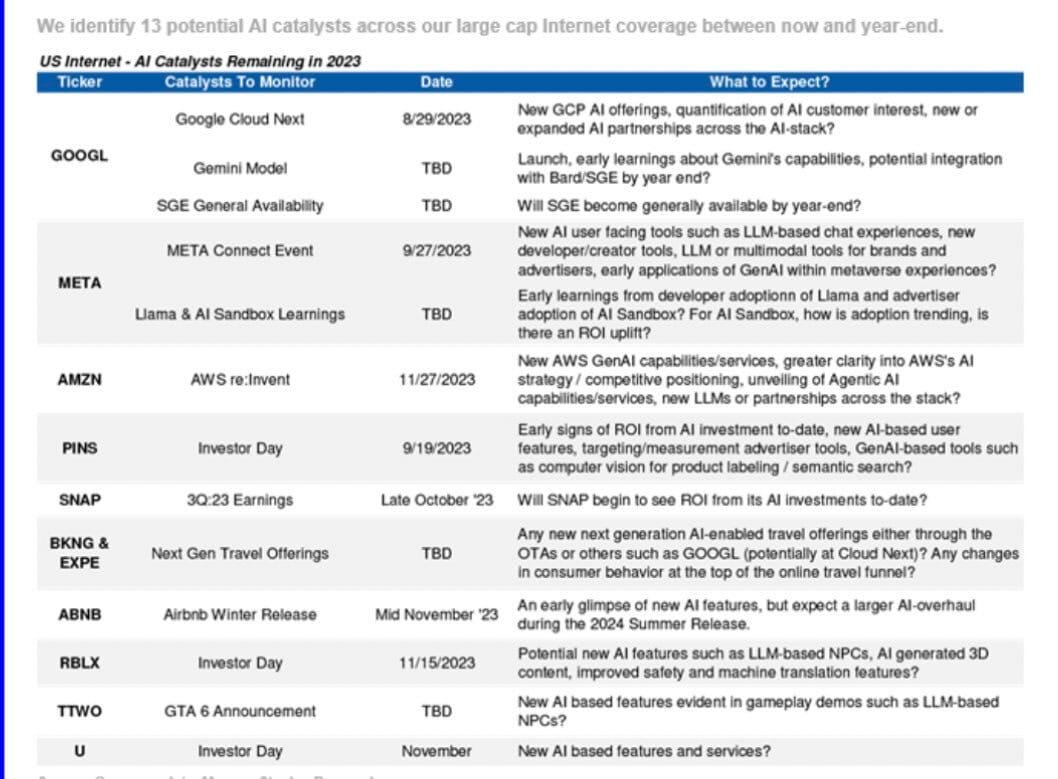

Brian Nowak must have hired some new staff because the latest on Meta is actually pretty well rounded. Here’s MS’s latest take on the top AI catalysts between big tech co’s:

Post- Earnings Analyst Chatter

After a strong call, fundamental and technical analysts are split on what to do with the stock - one faction says “strong sell” , the other “ strong buy”. Overall consensus is somewhere in the middle ( leaning towards buy) - but it begs the question, why the difference in opinion?

Source: TR, Aug 30, MTD data

It may have something to do with the stock being more volatile - especially since it couldn’t find support over $300.

Source: Barchart, Aug 30

Next week: Gear up for a longer deep dive research issue 🙂

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by That's So Meta, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed.