- That's so Meta

- Posts

- Before The Earnings Call Breakdown

Before The Earnings Call Breakdown

Learn which analyst is right about META 77% of the time.

Ahoy Metamates! 🚢 🏴☠️

🆕 The TLDR This Week

Meta spent US$3.65 million on lobbying the government in Q4

LinkedIn data suggests Meta hired only 68 people in January so far ( vs 3929 last year)

Meta gets positive stock analyst mentions on NBA game Quest play

Analysts are speculating Twitter's lost advertisers will migrate to Meta

The Doors Have Closed

Outside very senior hires, Meta has ground to a halt on hiring across the board, if LinkedIn data is to be believed.

I see interviewing going on still - and I'm also seeing delayed offers. Some people are not starting until February ( but were hired December). Still, hiring 67 people this January vs 3929 people same time last year is semi-dystopian.

When I posted this on Linkedin, a possible explanation emerged:

Deep Dive BEFORE the Earnings Call Tomorrow

'Twas the night before Earnings, when all through the house

Not an analyst was stirring, not even a mouse;

The finances were posted by Meta with care,

In hopes that Morgan Stanley would chill TF out when they see what's there....

In this subscriber-only deep dive, we will go over the metrics of what's happened so far since last quarter and what to look out for tomorrow leading up to the earnings call. Shortly after Earnings, I will start assembling the post-earnings breakdown going over all stock price rank changes and analyst reports.

Let's unpack the numbers leading up to February's Earnings Call:

📈 📈📈 Stock price targets from Goldman, Morgan, JPM and others

Why every Meta employee should know who Brian Nowak is

Options market volume and activity - are people betting on a stock comeback?

Institutional investors making moves right now

Breakdown of themes from the last earnings call

🔥Hey Friends, this issue is for subscribers only. It takes me a ton of effort to research each issue and get you unique insights. Please consider subscribing to keep this going.

The good, the bad, the UGLY

Growth stocks generally do worse in a down economy, but what happened to Meta last quarter was pure brutality. To understand what to look for tomorrow, you first need to get the chess pieces down.

Here's the TLDR for the last 2 quarters:

Everyone but Goldman Sachs was skeptical on the metaverse spend

Piper Sandler put out two reports showing data Meta growth was slowing significantly

Analysts started referencing those metrics and we saw some moderate downgrades

The bottom fell out when Meta announced an increase AI spend that was unexpected

Analysts hate surprises.

Shortly after the AI announcement, Morgan Stanley went full throttle. Brian Nowak and his team at MS issued a scathing report, cutting their projections ~ in half.

Other analysts followed.

Stock analysts are pack animals - so when the tiger in the jungle says jump, the other analysts would rather conform than risk sticking out. That was a bad metaphor but you get the picture.

Meta tried to save the narrative by pushing out PR around Cicero but it was too late. There was blood in the water and layoffs were the only way to cut OPEX fast enough to salvage the next earnings cycle. This was not a pre-planned layoff, it was an emergency- WTF-do-we-do-now layoff.

Who's a Friend and Who's Not

Every Meta employee should do 2 things to advocate for their stock compensation:

1) Learn the name of every major analyst

2) Tag analysts and engage productively on posts explaining why newly released tech is important / how it can be profitable. Because there's a damn good chance it's opaque to both analysts and journalists without your help.

So.... who are these "analysts"? There's 58 of them but you should probably start by learning the 3 everyone on your executive team loses sleep over.

The definitive list of people you should be googling tomorrow:

Lean, mean Meta stock rating machine - this man has one of the best track records on getting the stock movements + looks past the obvious metrics on his reporting.

77% success rate on Meta ratings

+20.72% profitability return on rating, as of date of writing this

Understands tradeoffs on long technical bets

One of the days I will make a T-shirt that says "Eric is PAPI" - because he so is. We love him, we want more of him. His analysis is always very well thought out. He's not always bullish on Meta but he aways has the technical fundamentals right so his opinion is worth listening to imho.

Leading analyst for Meta at Goldman Sachs

24 out of 37 ratings were profitable on META ( 65% success rate)

Early advocate for the metaverse , consistently well researched analysis

I semi-famously said Brian should get coal for Christmas because poo- pooping on Meta for its AI investment spend should automatically disqualify you as being competent to report on the stock. Literally BYE.

MD at MS, leads reporting on Meta

34 out of 57 ratings were profitable on META ( ~ 60%)

Currently bullish on Google and Amazon

State of the META Stock pre- earnings

Note: The following is not financial advice personal to you, the reader, but broad financial analysis and opinion. Do not act on this without consulting a financial advisor for your specific situation - since that may involve other factors like taxes or liquidity goals that are not considered here.

Note that this may change after earnings call details are released and I will cover those changes in the next issue.

Out of the 58 analysts covering META, majority consensus today is BUY rating.

What this meant to you as a RSU holder:

BUY means analysts consider there to be stock upside in the future

If you hold RSUs, this means if you sell too fast you could experience a loss relative to the terminal projected value of the stock in the next 12 months

Holding onto all of your RSUs on a weak BUY rating can expose you to too much market risk on a volatile growth stock like Meta, esp if you're concetrated.

A strategy to consider is selling a % vs all at vest or being on a 10b5-1 plan

📈📈📈📈 Price targets ( as of Jan 31st, 2023):

Note that this will change after earnings call details are released and I will cover those changes in the next issue.

Consensus 12 month target: $163.25

Lowest projection: $104

Highest projection: $260

What this meant to you as a RSU holder:

The spread is pretty big, which is likely underpinned by lack of consensus on the macro environment

Analysts who are at the higher end of the spectrum (over $200) are from smaller shops with less track record.

Last posted ratings from the big 🐶: Morgan Stanley $130, JP Morgan: $150, UBS: $158, Goldman Sachs: $165, Barclays: $165.

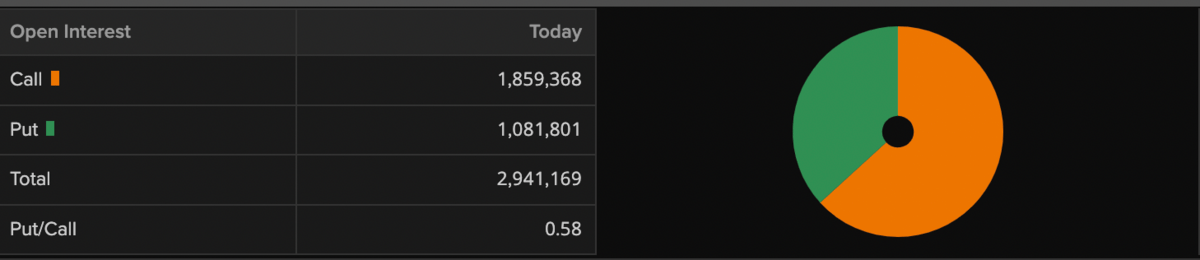

Derivatives market chatter / options activity

source: Refinitiv, Jan 31 2023, post market close.

What this meant to you as a RSU holder:

On the eve of the earnings call, most traders have bought calls

Calls = betting that there will be a price increase

This signals the market is going in positive into the call tomorrow

If you want a deeper dive, go here. This is a very fast moving market so I do not encourage day or short term trading based on this information unless you're a professional who owns at least one pair of suspenders, sitting in front of a terminal, drinking too much coffee while doing your best not to blink too much. Even then, it probably is not a great idea to ride short term volatility.

Institutional Activity

There's been no super major movement for the top 5 institutional holders of META. However, we are seeing some movement for smaller shareholders. Most recently:

source: Refinitiv, Jan 31 2023, post market close.

Explanation of what you're looking at:

Buy side-

Morgan Stanley US picked up some shares, while Morgan Stanley Singapore dumped some. That's why you're seeing it on both sides.

T.Rowe, Voya and Amundi picking up shares is a positive sign because all 3 are generally conservative

Susquehanna, or SIG, is a quant hedge fund, known for handling ~ 1 in 7 stock options traded in the world so this is probably a short term buy from them for a strategy

Sell side-

Baille, Capital World and T.Rowe do a lot of pensions and 401k

T.Rowe still remains Meta's 6th largest institutional and has LOW turnover so this move is not considered anything major.

Renaissance is a quant hedge fund that frequently moves large positions so not unusual

TLDR: This is a period of high speculation where hedge funds are looking for an edge. Meta's key institutional investors have largely kept low turnover. More pension and 401k purchases creeping in signals stronger belief in potential upside.

What to Expect Tomorrow:

Earnings call will be at 2 PM PST - sign up here

If you are a Meta employee, I recommend reading the transcript of the previous call to prepare- it's right here.

I will listen to Earnings live and then post an initial breakdown once analysts react

We will look at the revised narrative and price projections together next issue.

Make sure you're subscribed to receive the full Earnings recap from Feb 1 next week.

💗 And, as always, I'd love your help spreading the word about this newsletter to anyone who'd find it helpful or interesting.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by That's So Meta, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed.